Key Metrics

Results you can measure and trust

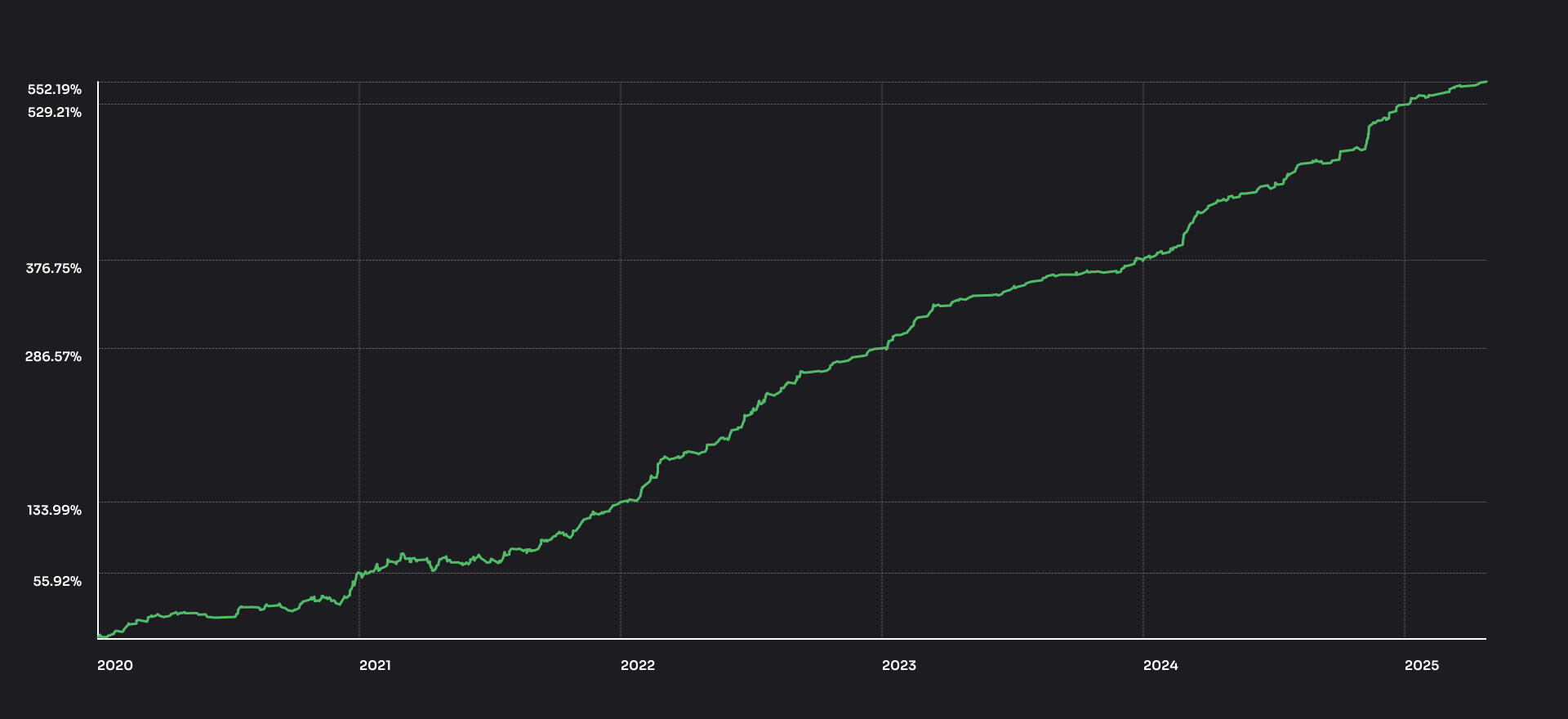

93.86%

Average Annual Return

-10.58%

Max. Drawdown

4.77

Sharpe Ratio

21.18

Calmar Ratio

$2M+ CHOOSE TRENQ

We build strategies and infrastructure that deliver consistent returns and risk management for funds, brokers, and professional investors.

We bring the strategies and infrastructure, you keep the custody and control, giving your business the tools to grow with confidence.

Tested. Matched. Proven.

Annual Trading Volume

Assets Under Management

Average Annual Return

Max. Drawdown

Sharpe Ratio

Calmar Ratio

No. We operate on a non-custodial model. Clients capital remains in their own exchange accounts we connect only via API.

For proper operation, only read and trade permissions on the futures account are required.

Our goal is to maintain maximum transparency. All of our results can be verified in the Live Performance tab and further validated using Binance.

Our systems use pre-defined stop-losses, position sizing, and drawdown controls tailored to institutional-grade risk frameworks.

We provide software, strategies, and monitoring tools with the flexibility to execute trades either manually or automatically. Our clients can fully automate their trading through our solutions while maintaining full oversight and control over execution.

We support Binance and ByBit and offer the ability to integrate custom infrastructure if needed.